Cryptocurrency, Energy, and Proof-of-Stake

New to cryptocurrency? Check this out for a quick primer. One of the giant debates, often a significant source of criticism, is Bitcoin’s energy efficiency (or lack thereof). This criticism may also be expanded to any other currency, or blockchain backed technology that leverages proof-of-work as a consensus mechanism. Innovation is inherent in technology. New ideas, methods, and optimizations come along to take something, add new features, and make it more efficient. One such optimization is proof-of-stake which brings a greener look to consensus. How much can it help?

Bitcoin - Energy Consumption

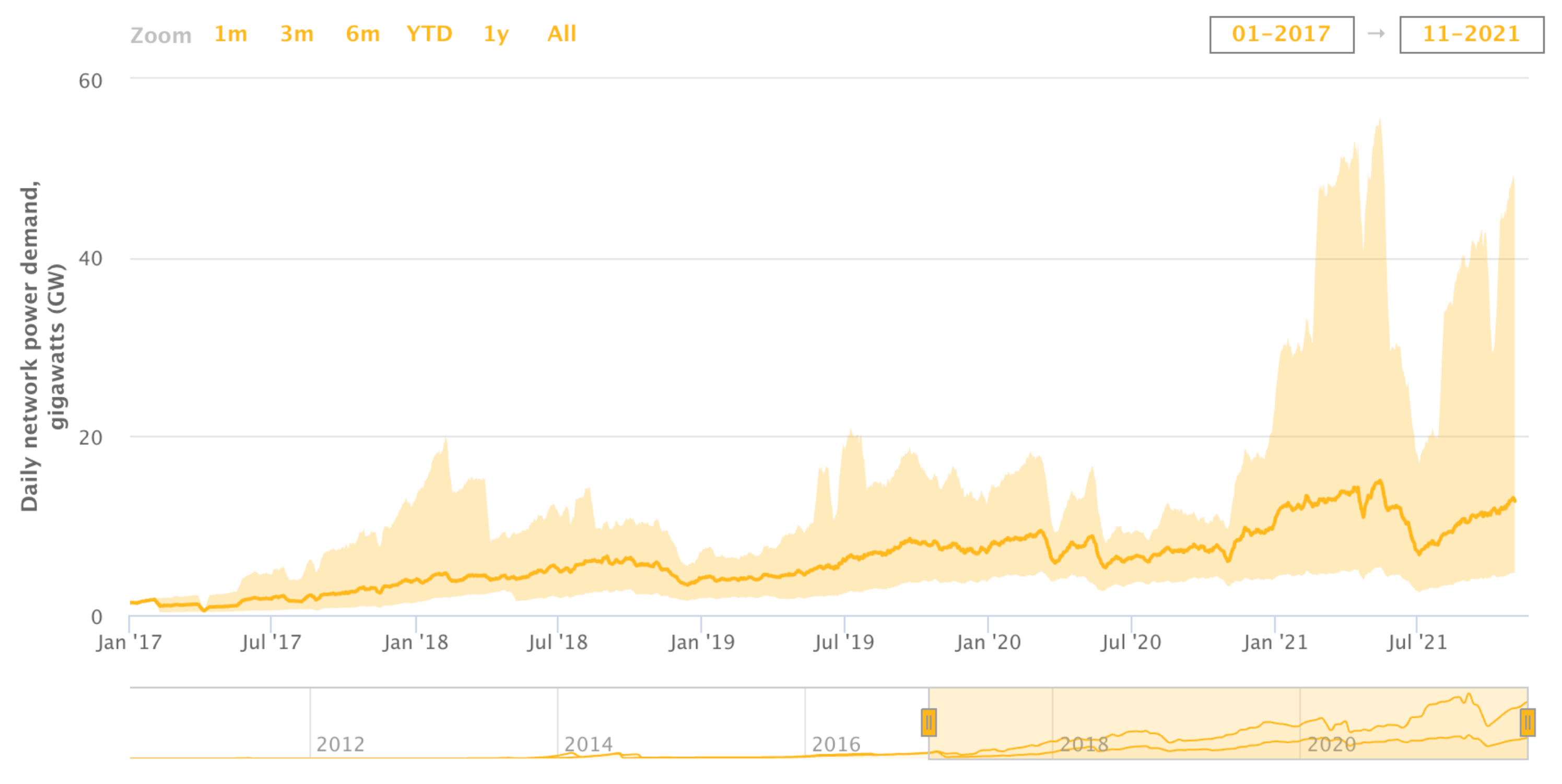

The Digital Assets Programme (DAP) Team at The Cambridge Centre for Alternative Finance maintains a fantastic project called The Cambridge Bitcoin Electricity Consumption Index (CBECI) that estimates the power demand for the Bitcoin network. The material presented gets updated every 24-hours. Today, the estimated annualized consumption of the Bitcoin Network is > 111 TWh. A terawatt-hour is one trillion watts per hour, equal to 3.6x1015 Joules.

Historical - Bitcoin Network Power Demand (Daily)

Historical - Bitcoin Electricity Consumption (Monthly)

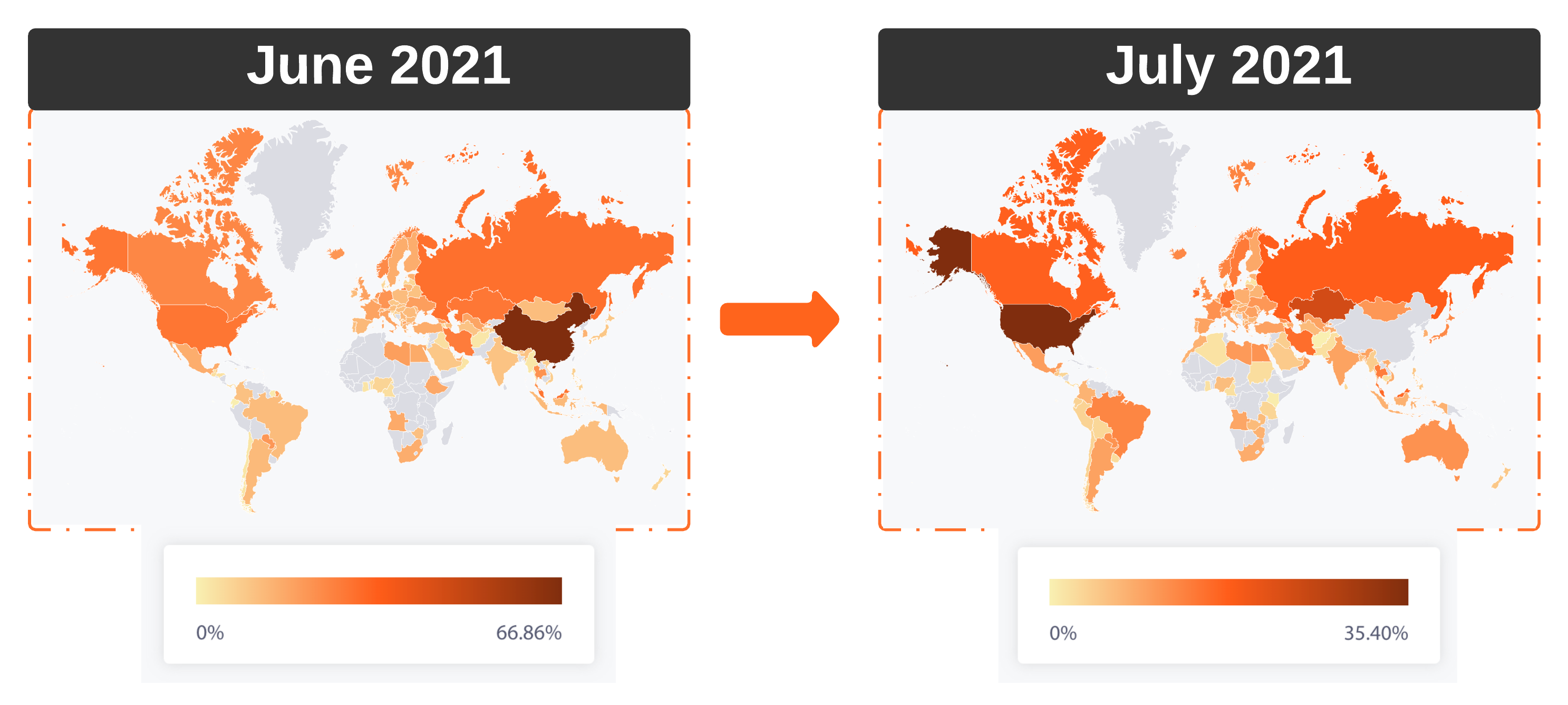

Bitcoin Mining Map (June-July 2021)

The following map visualizes monthly hashrate by country and region. Notice something different from June -> July 2021? To zoom in further, in September 2019, China accounted for 75% of the world’s Bitcoin mining energy consumption. Following China’s ban of trading and mining crypto, we see the U.S. become the number one hot spot.

Comparison - Countries And Data Centers (Globally)

Let’s put Bitcoin’s energy footprint into perspective by comparing it to some other things that we have a better grasp on.

| Name | Population (Million) | Annualized (TWh) |

|---|---|---|

| China | > 1,446 | > 6,000 |

| United States | > 333 | > 3,000 |

| Data Centers (globally) | - | > 200 |

| Bitcoin Network | - | > 115 |

| Netherlands | > 17 | > 113 |

Elon Musk Tweets

Nothing can move mountains and markets quite like Elon Musk tweets. The very purpose of Tesla’s existence is to accelerate the world’s transition to sustainable energy, as noted in the 2020 - Tesla Impact Report which is why this tweet comes as no surprise.

Tesla & Bitcoin pic.twitter.com/YSswJmVZhP

— Elon Musk (@elonmusk) May 12, 2021

Consensus Mechanisms

Blockchain backed technologies like Bitcoin are essentially distributed databases which are bound by the laws of CAP theorem. With blockchain, nodes must reach an agreement on the current state of the network by using a consensus mechanism.

What Is Consensus With Blockchain?

Consensus means agreement. With blockchain, that agreement happens when 51% of the nodes on a network agree on its next global state. Consensus mechanisms (or algorithms) in a crypto-economic system enable networks to achieve this while preventing common attacks. A successful exploit, in theory, would compromise consensus by controlling >= 51% of the network. Consensus mechanisms exist to negate that 51% attack.

Proof-of-Work

Proof-of-Work (PoW), initially introduced in 1993 by Cynthia Dwork and Moni Naor to mitigate DDoS attacks, is the consensus mechanism used by many cryptocurrencies today like Bitcoin and Ethereum. This algorithm sets the difficulty and rules while the miners perform the actual work of adding valid blocks to the chain. Mining cryptocurrency requires specialized hardware that uses a substantial amount of electricity. Also, as difficulty increases, so does the computational power necessary to get the hash value. The penalty for bad actors submitting invalid blocks is losing computational power, energy, and time.

Proof-of-Stake

Proof-of-Stake (PoS) was introduced in 2012 by Sunny King and Scott Nadal as an alternative to proof-of-work. At its core, proof-of-stake works to help reach consensus securely but does it in a fundamentally different way than proof-of-work. In a proof-of-stake system, miners don’t need to spend electricity on adding valid blocks to the chain, thus allowing the network to operate with substantially lower resource consumption. The penalty for bad actors on a proof-of-stake network is more severe. The validators’ staked funds serve as the incentive to refrain from malicious intent. If a validator accepts a bad block, a portion of their staked funds will be slashed as a penalty.

Comparing PoW and PoS

| Proof-of-Work | Proof-of-Stake |

|---|---|

| Miners compete with hardware to create new blocks full of processed transactions | Validators are randomly selected based on their stake in the network (how many coins they hold) |

| Rewards systems, like Pay Per Last N Shares (PPLNS) compensate miners | Validators do not receive block rewards; Transaction fees are collected as compensation |

| Additional currency created as rewards for miners; Contributes to price volatility | Decreasing need to add coins to circulation; May contribute to price stability |

| Adding a malicious block requires a node more powerful than 51% of the network | Adding a malicious block would require owning at least 51% of all the cryptocurrency on the network |

| Low transactions-per-second | High transactions-per-second |

| Susceptible to Tragedy of the Commons | Susceptible to Nothing at Stake |

Going Green

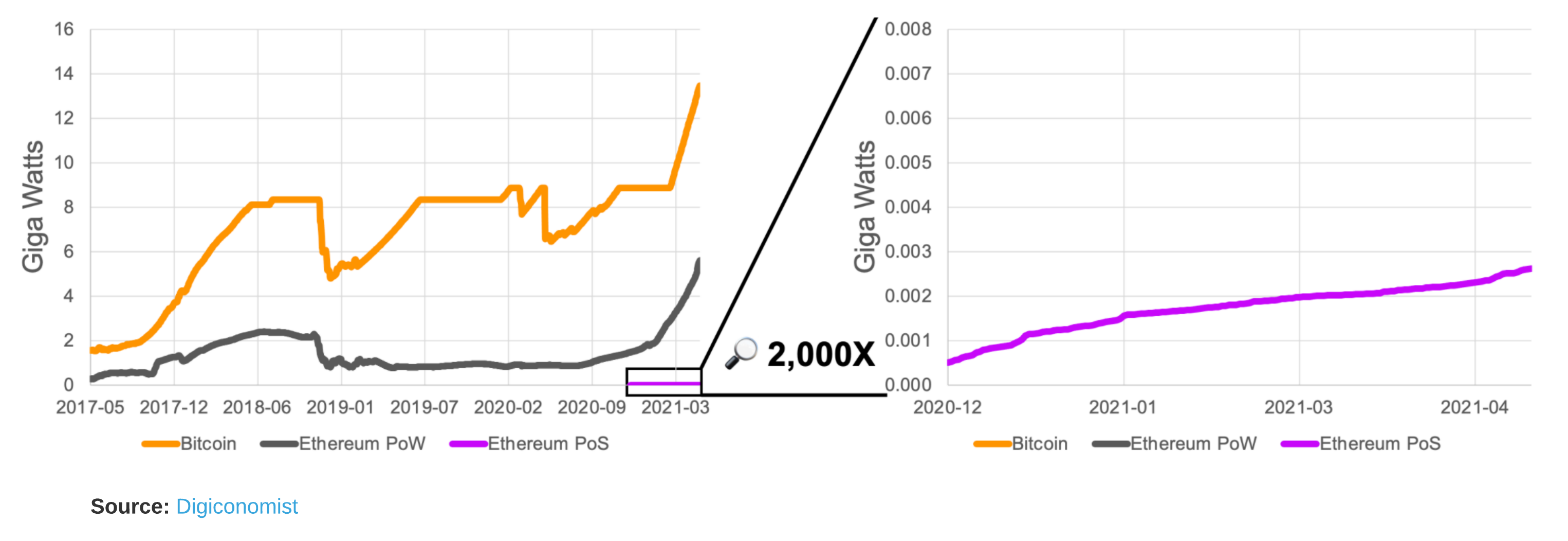

Depending on one’s definition of going green, that wording could be a mild stretch. One thing is for sure, optimizing to use less energy is a win. What if cryptocurrencies, like Ethereum, could use ~99.95% less energy by transitioning to proof-of-stake for consensus?

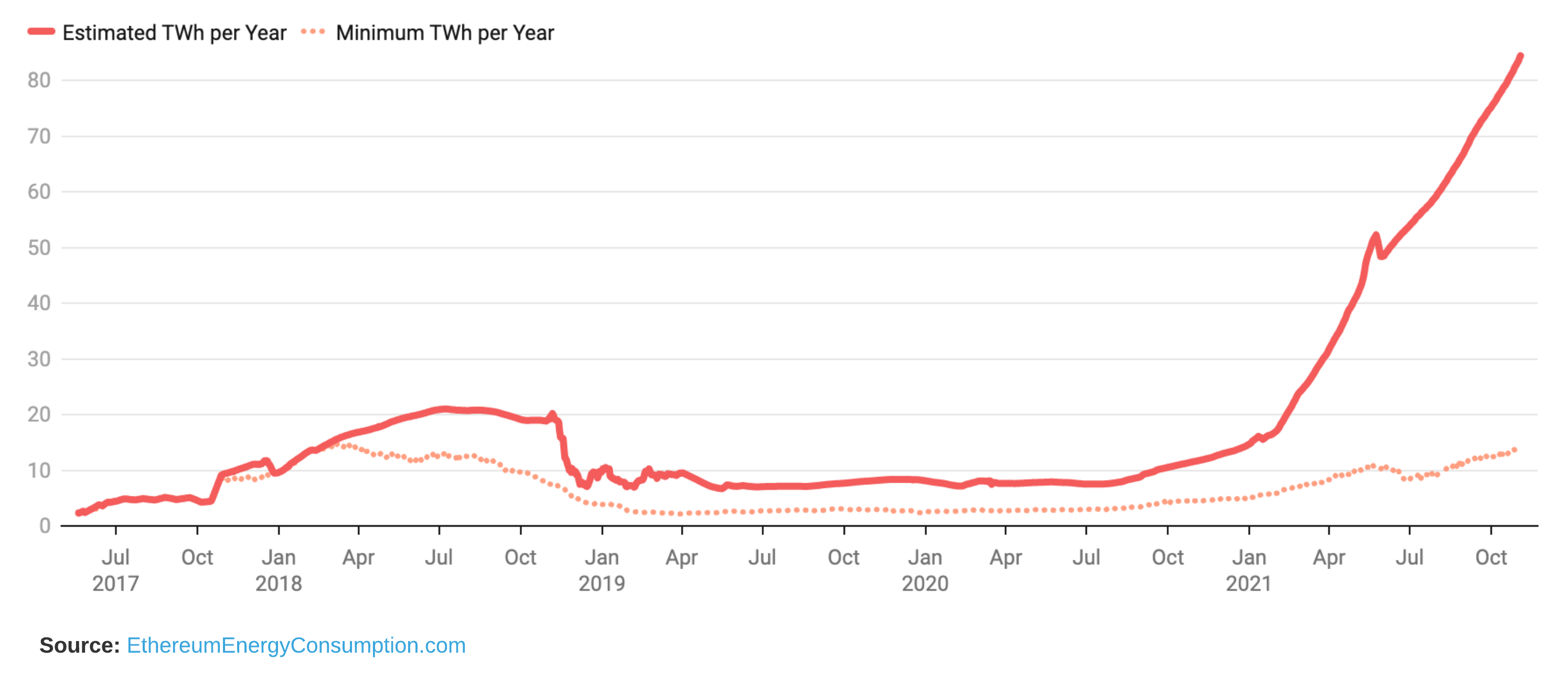

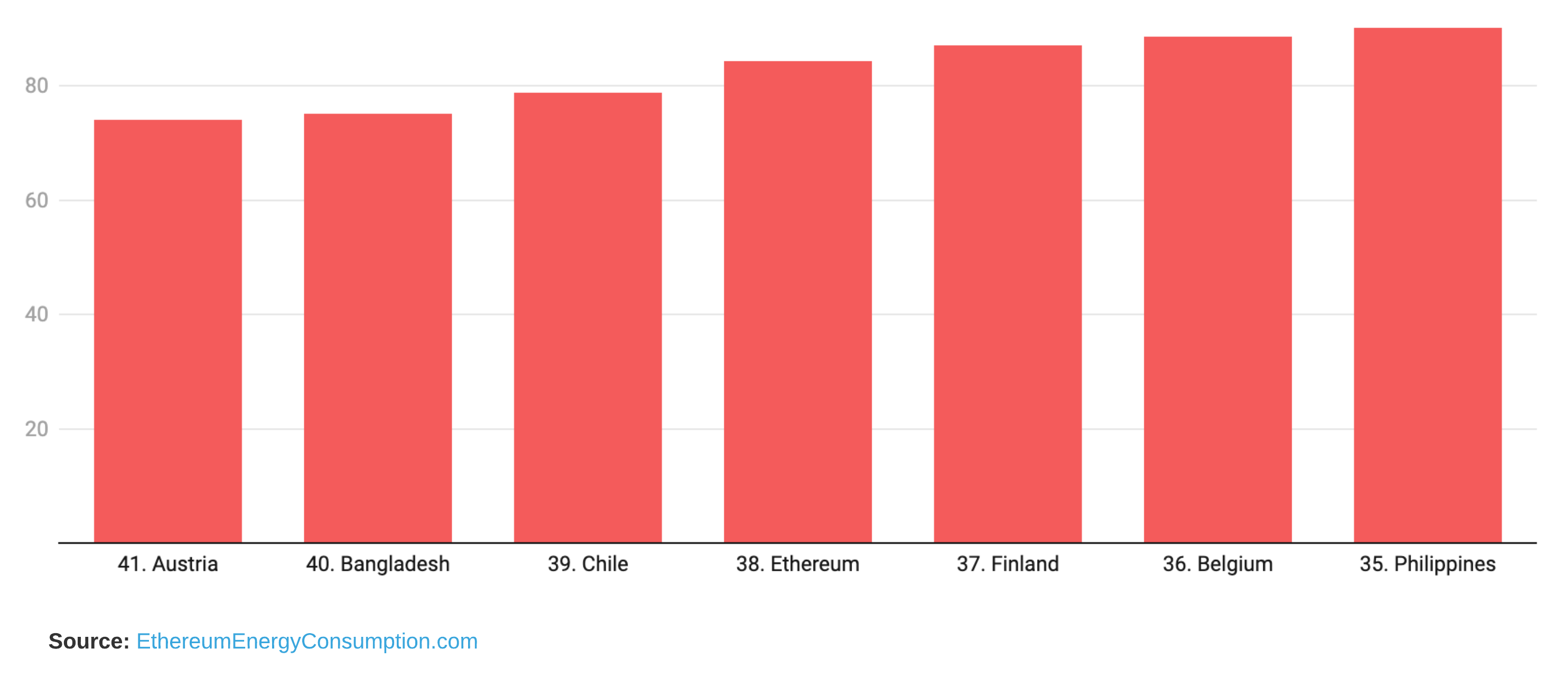

Ethereum - Energy Consumption And Scale

Ethereum, the second-largest coin by market capitalization, was launched in 2015 by Vitalik Buterin. While Bitcoin, long-term, could be viewed more as a store of value similar to gold, Ethereum offers more utility with its smart contracts driving the decentralized finance (DeFi) and NonFungible Token (NFT) arena. Today, Ethereum uses proof-of-work for consensus, which presents limitations at scale. Not only does it consume a country’s worth of power, but the blockchain also struggles to keep up due to popularity and demand. Smart Contracts, NFT minting + sales, and DeFi transactions increasing have caused a spike in fees.

Ethereum - Estimated TWh Today (Annualized)

Comparison To Other Countries Today

Solving For Power And Scale With Ethereum 2.0

Knowing the scalability and environmental challenges that come with proof-of-work, the Ethereum team has long-planned to upgrade to proof-of-stake consensus across 3 phases, the first of which, The Beacon Chain was implemented in Dec. 2020. The second phase, The Merge is slated for ~Q2 2022 at which point, staked Ether will take the place of mining. The last phase, Shard Chains, could potentially ship as early as late 2022 (depending on results of the merge), and greatly optimizes data and transactions.

Comparing PoW and PoS Power Requirements

A massive reduction in power can be observed when taking mining out of the picture. It is projected that Ethereum will use ~99.95% less energy post-merge. Therefore, instead of comparing the entire network’s consumption to a medium sized country, a more accurate comparison would be a small town of around 2,000 homes.

Scaling Transactions

Visa handles an average of 150 million transactions every day, or approximately 1,736 transactions-per-second. Today, Bitcoin handles somewhere between 4-7 transactions-per-second, with Ethereum coming in at around 13 transactions-per-second. The last phase of the shift to proof-of-stake introduces secure sharding, enabling Ethereum to create blocks simultaneously. According to Vitalik Buterin, this has the potential to scale up to ~100K transactions-per-second.

ETH2 scaling for data will be available *before* ETH2 scaling for general computation. This implies that rollups will be the dominant scaling paradigm for at least a couple of years: first ~2-3k TPS with eth1 as data layer, then ~100k TPS with eth2 (phase 1). Adjust accordingly.

— vitalik.eth (@VitalikButerin) June 30, 2020

Market Implications

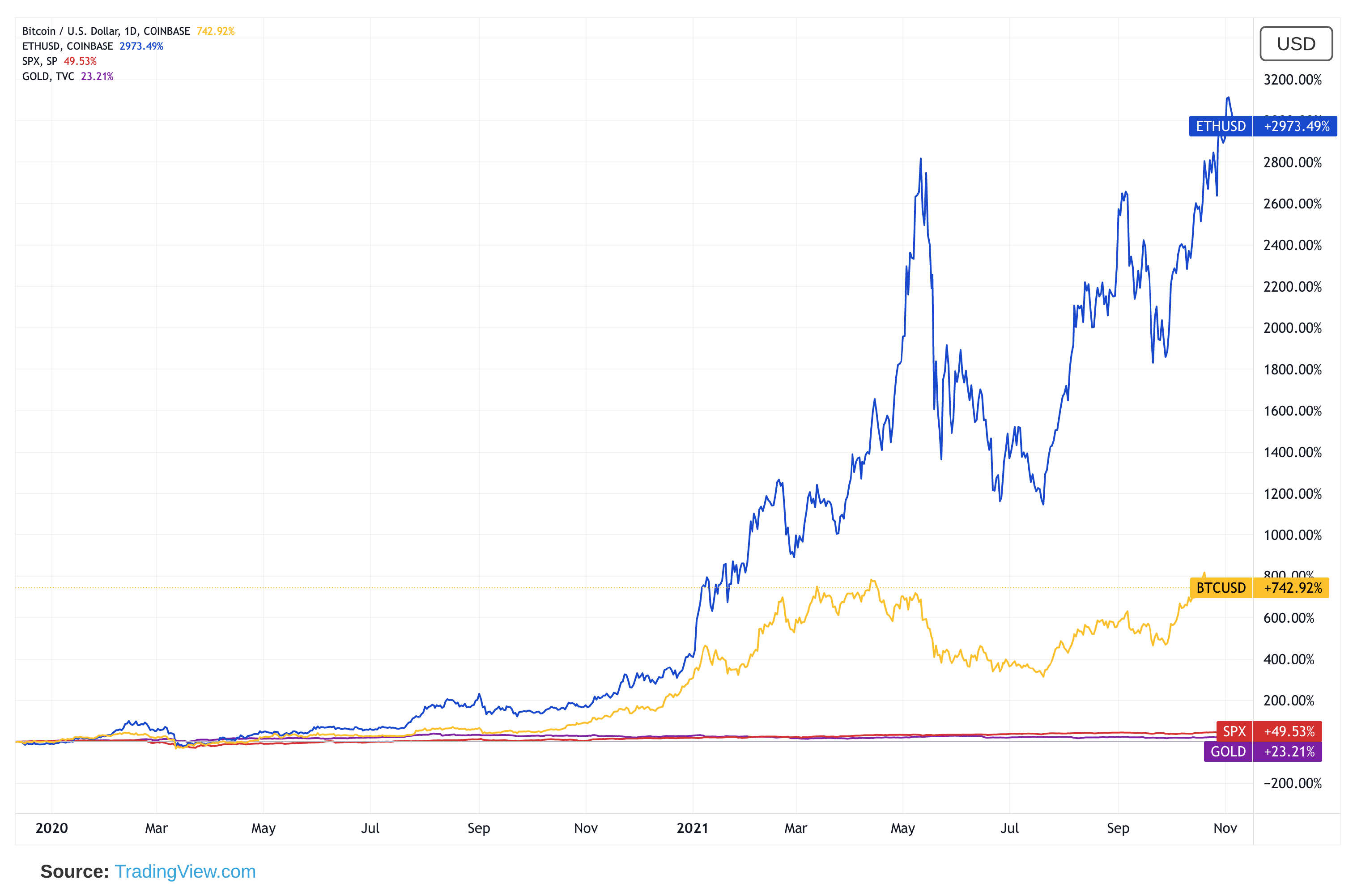

Historically, precious metals were considered the go-to for hedging against inflation. Going into 2020, crypto has become an increasingly popular alternative. This is likely one of the contributing factors as to why Bitcoin outperformed all other major asset classes in 2020. How are things shaping up as we near the latter part of Q4 - 2021?

Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair.

- Sam Ewing

Crypto ROI VS Traditional Investments (2020-2021)

In 2020, cryptocurrency outperformed Gold and the S&P 500. Looking back over 2021, this gap has widened even further, with Ethereum starting to make big waves as it outperforms Bitcoin in price appreciation terms this year. Could this be resulting from the process and changes Ethereum is undergoing as it transitions to proof-of-stake?

Wall Street Appeal

To me, it makes sense that Ethereum’s transition to proof-of-stake will garner increased interest from the financial establishment. I only say this because post upgrade, staked Eth will operate more like a digital bond. Instead of being a virtual commodity, it will be closer to a financial asset. Capital gets positioned, and then the yield VS price gets calculated. This makes it simple to regulate and even easier to tax (like a bond yield).

Conclusion

Cryptocurrency is still in its very early stages. Can proof-of-stake have an impact on the heavy energy demands of crypto today? From watching the news or reading any major publications, it would seem that the market is not so much fixated on functionality but on price. With Ethereum, transaction fees increase as the demand for Ethereum rises, which directly impacts the price. To me, this is a direct indication of its utility today, which drives the price higher.

One thing that remains unclear is, what happens to the second-largest coin by market capitalization as it completes this gigantic transition to proof-of-stake and takes on the persona of an interest paying bond or equity? Does this negatively impact the link between Ethereum price and transaction cost, or does increased utility and adoption along with significantly less energy demand drive Ethereum parabolic? The world will soon find out!